2025 FX Forecast: Euro Strength, Dollar Weakness, and the Great Currency Reset

Global FX Outlook: 2025 Currency Forecast Amid Trade Turbulence

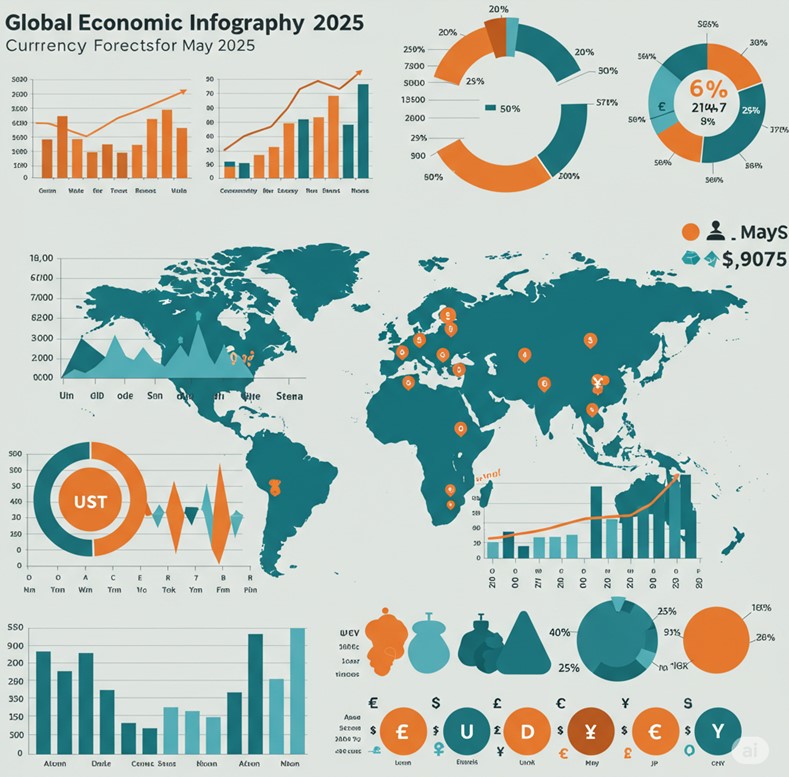

The global economic and currency landscape in May 2025 is navigating choppy waters, shaped by intensifying US-led trade protectionism and widespread tariff escalations. These developments have introduced heightened volatility and uncertainty into the global macro environment, directly influencing foreign exchange (FX) markets. As central banks pursue increasingly divergent monetary policy paths, currency traders and investors are facing a fragmented and unpredictable landscape.

Trade Protectionism Takes Center Stage

At the heart of global market anxiety lies the resurgence of trade protectionism, with the United States leading a wave of tariff implementations aimed at recalibrating trade balances. These measures have not only strained international relations but have also become the single most destabilizing factor for financial markets and global growth.

Trade tensions have triggered sharp risk-off moves in financial markets and led to increased volatility across major currency pairs. Investors are pricing in heightened geopolitical risk premiums, with safe-haven flows distorting traditional valuation models.

Global Growth Outlook Worsens

Global economic momentum has slowed considerably. Both the International Monetary Fund (IMF) and the OECD have revised down their 2025 growth projections, citing trade policy uncertainty and the knock-on effects of tariffs. The US economy, which previously stood out for its resilience, contracted modestly in Q1, with analysts now forecasting a significant deceleration to just 0.5% real GDP growth in Q4.

Europe has seen mixed results. While the eurozone posted moderate Q1 growth, purchasing managers’ index (PMI) data suggests stagnation in April, particularly in the services sector. The UK outlook appears gloomier, with composite PMI slipping into contraction territory and the threat of stagflation growing more pronounced. Meanwhile, China’s impressive 5.4% Q1 growth—fueled by stimulus—faces strong headwinds from US tariffs, as reflected in a weakening Q2 PMI.

Commodity-driven economies like Australia and Canada are also slowing, with their currencies reacting sharply to shifts in global trade flows and commodity price movements.

Inflation: A Mixed Bag

Inflation trends are equally fragmented. The US is grappling with slightly elevated inflation, exacerbated by tariffs pushing up input costs. The Federal Reserve is caught between opposing forces: cost-push inflation on one side, and demand destruction on the other.

The eurozone is experiencing a more controlled disinflation process, with the ECB responding with a modest 25bps rate cut in April. The UK, however, remains at the forefront of stagflation risks, as inflation decelerates unevenly while growth falters. Japan and China, facing deflationary pressures, have taken a more cautious or stimulative approach, respectively.

Diverging Central Bank Paths

Monetary policy divergence has become a defining feature of 2025. The Fed, while holding steady on interest rates, is clearly signaling concern over the economic impact of trade policy. Market expectations are leaning toward a rate cut in September as the Fed attempts to navigate conflicting macro signals.

The ECB is maintaining a data-dependent stance following its April cut, with further easing likely but not guaranteed. The Bank of England is widely expected to cut rates in May, reflecting weak domestic data and the growing threat of stagflation. In contrast, the People’s Bank of China (PBoC) is ramping up stimulus efforts to cushion the economy from deflation and external pressures. The Bank of Japan, while maintaining rates, has revised down both growth and inflation forecasts.

Commodity currencies face even greater sensitivity. The Reserve Bank of Australia and the Bank of Canada are both managing policy against a backdrop of trade-driven demand shocks and volatile commodity markets.

Currency Market Forecasts: USD Weakness Dominates

The US dollar (USD) is expected to remain under broad pressure in the coming months. The fading “US exceptionalism” narrative, coupled with tariff-induced economic drag, has triggered a meaningful correction in the greenback. A dovish Fed stance adds to the bearish sentiment, with most major institutions projecting continued USD softness against G10 peers.

EUR/USD is seen as a key beneficiary. Relative resilience in European growth, a less aggressive ECB easing trajectory, and capital inflows are supporting the euro. Market sentiment is increasingly bullish on the EUR, particularly as the ECB takes a more balanced stance than the Fed.

GBP/USD, on the other hand, remains under pressure. The Bank of England’s expected rate cuts, combined with weak growth data and inflationary constraints, point to limited upside potential.

USD/JPY is likely to stay volatile. The yen’s dual identity as both a safe-haven asset and a currency influenced by ultra-loose monetary policy complicates its outlook. While BoJ caution limits rate hikes, risk aversion could drive yen appreciation.

USD/CNY is projected to remain relatively stable, managed tightly by the PBoC to prevent capital outflows and maintain macro stability, even as it rolls out further easing measures.

AUD and CAD are expected to remain sensitive to swings in global risk sentiment and commodity prices. The Australian dollar is finding support from strong commodity demand and relatively restrained RBA action, while the Canadian dollar has held up well despite tariff exposure and looming BoC easing.

Strategic Implications for Traders

The current FX environment demands a high degree of agility and risk management. With uncertainty centered around US trade policy, key opportunities lie in:

- Short USD exposure, particularly versus EUR and potentially JPY.

- Tactical long positions in AUD and CAD on dips, especially if commodity prices remain supported.

- Avoiding crowded trades, especially in speculative positioning against JPY or EUR.

- Monitoring central bank communication and macro data for signs of policy shifts or trade escalation.

In sum, while the USD is likely to trend weaker amid trade-related drag and dovish signals from the Fed, FX markets remain highly reactive. Traders should focus on diversification, flexible strategies, and vigilant monitoring of trade-related developments and central bank actions.